south carolina inheritance tax 2020

For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. Individual income tax rates range from 0 to a top rate of 7 on taxable income.

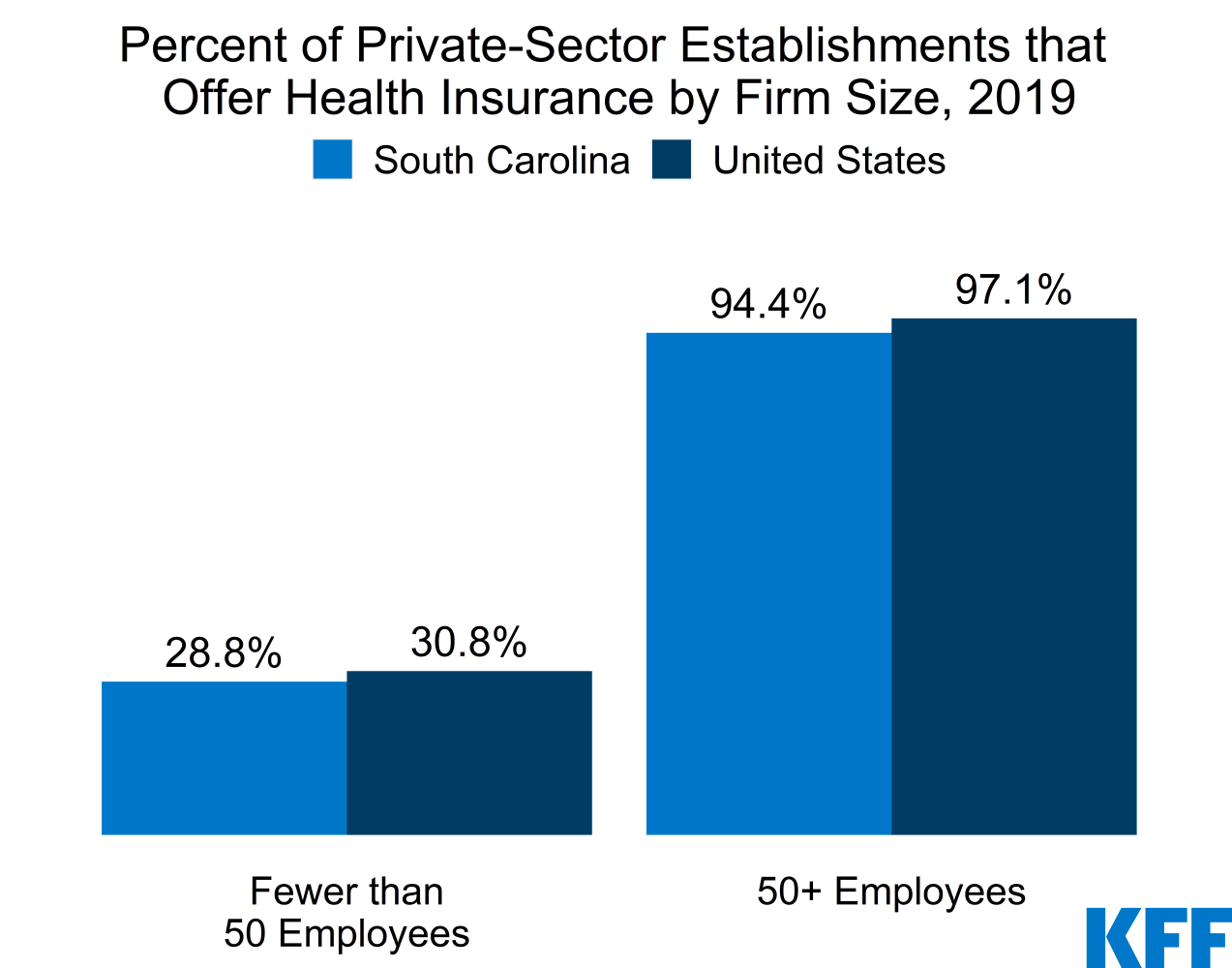

Every employerwithholding agent that has an employee earning wages in South.

. The top estate tax rate is 16 percent exemption threshold. However you are only taxed on the overage not the entire estate. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Even when a federal estate tax return will be required no federal estate tax is currently imposed upon property passing to a surviving. Friday February 21st 2020 207 pm. The average local tax was about 122 percent meaning that the average combined sales tax was about 722 percent.

The federal estate tax exemption is 117 million in 2021. The Form 706 is due nine months after date of death. The top estate tax rate is 16 percent exemption threshold.

There are no inheritance or estate taxes in South Carolina. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Inheritance tax applies to money and assets after they are passed on to a persons heirs who are responsible for paying.

South Carolina does not assess an inheritance tax nor does it impose a gift tax. Federal Estate Tax. The top estate tax rate is 16 percent exemption threshold.

Contrary to what many people think federal estate taxes do not apply. The inheritance tax is different from the estate tax. It is one of the 38 states that does not have either inheritance or estate tax.

Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. But if you live in South Carolina and you receive an inheritance from another estate you could.

If an estate is valued over a certain amount 1158 million in 2020 the estate is subject to an estate tax. South carolina does not levy an inheritance or. Filing electronically is the fastest and easiest way to complete your return plus.

South Carolinas state sales tax was 600 percent in 2017. News On 6 News On 6. As of 2021 33 states collected neither a state estate tax nor an inheritance.

Your federal taxable income is the starting point in determining your state income tax liability. This threshold changes often but in 2020 the threshold was 1158 million. If an inherited estate is valued above that amount then the excess money is taxed.

Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020. South Carolina Inheritance Tax 2020. As of 2021 33 states collected neither a state estate tax nor an inheritance.

South Carolina offers several options for filing Individual Income Tax returns. However the Palmetto States. Tax was permanently repealed in 2014 with repeal of all.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you.

Free South Carolina Marital Settlement Divorce Agreement Word Pdf Eforms

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Creating Racially And Economically Equitable Tax Policy In The South Itep

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Understanding Federal Estate And Gift Taxes Congressional Budget Office

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

A Guide To South Carolina Inheritance Laws

Does South Carolina Require Inheritance Tax King Law

North Carolina Or South Carolina Which Is The Better Place To Live

North Carolina Or South Carolina Which Is The Better Place To Live

North Carolina Or South Carolina Which Is The Better Place To Live

South Carolina Court Of Appeals South Carolina Etv

Property Taxes Urban Institute

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die