salt tax deduction new york

52 rows As of 2019 the maximum SALT deduction is 10000. Supreme Court on Monday rejected a bid by New York and three other states to overturn a 10000 cap on federal tax deductions for state and local taxes that Congress.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Josh Gottheimer and Mikie Sherrill of New Jersey along with Rep.

. How does New York plan to work around this limitation. In tax years 2018 to 2025. The deduction has a cap of 5000 if your filing status is married filing separately.

That was the unequivocal statement in January from Reps. SALT Deduction Cap Stays in Place After Supreme Court Rejects New York Challenge By Aysha Bagchi Perry Cooper and Donna Borak News April 20 2022 at 1012 AM Share Print The Supreme Court. A larger group with 32.

The SALT deduction cap would stay at 10000 The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on corporations came with some. Imagine you have 150000 in adjusted. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

Overall the SALT deductions value as a portion of AGI fell between 2016 and 2018. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit. Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased new york state personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates.

It works like this. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. For many individuals the state income tax withheld plus the high real estate taxes often paid on the coasts greatly exceeded the maximum deduction of 10000.

The SALT deduction is an itemized deduction which includes state income tax or sales tax real estate taxes and personal property taxes. This provision is not available for publicly traded partnerships. In 2018 Maryland was the top state at 25 percent of AGI.

The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021. If this person also pays 40000 a year in real estate taxes then they would have been able to deduct 142750 from their federal taxable income if not for the SALT cap assuming this person is not subject to AMT. Assuming this taxpayer also owns a home in new york property taxes will consume much of the 10000 federal cap so this salt workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes.

With the SALT cap this person can deduct only 10000 so their federal taxable income would be 1490000 rather than 1357250. This election can alleviate the loss of the SALT deduction suffered by many New York taxpayers as a result of the federal SALT cap whether they are New York residents or non-residents. The federal offset of saving 1 of.

Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. For example the average SALT deduction claimed in New York was 23804 in 2017 and 5451 in Alaska in the same year according to Internal Revenue Service data. April 18 2022.

Tom Suozzi of New York. Prior to 2017s TCJA you were able to claim a deduction for all of the SALT that you paid during the year however the TCJA imposed a limitation such that only 10000 of SALT can be deducted on a personal tax return sharply reducing the total deductions for some taxpayers. In California the deductions value fell from 81 percent in 2016 to just 18 percent in 2018.

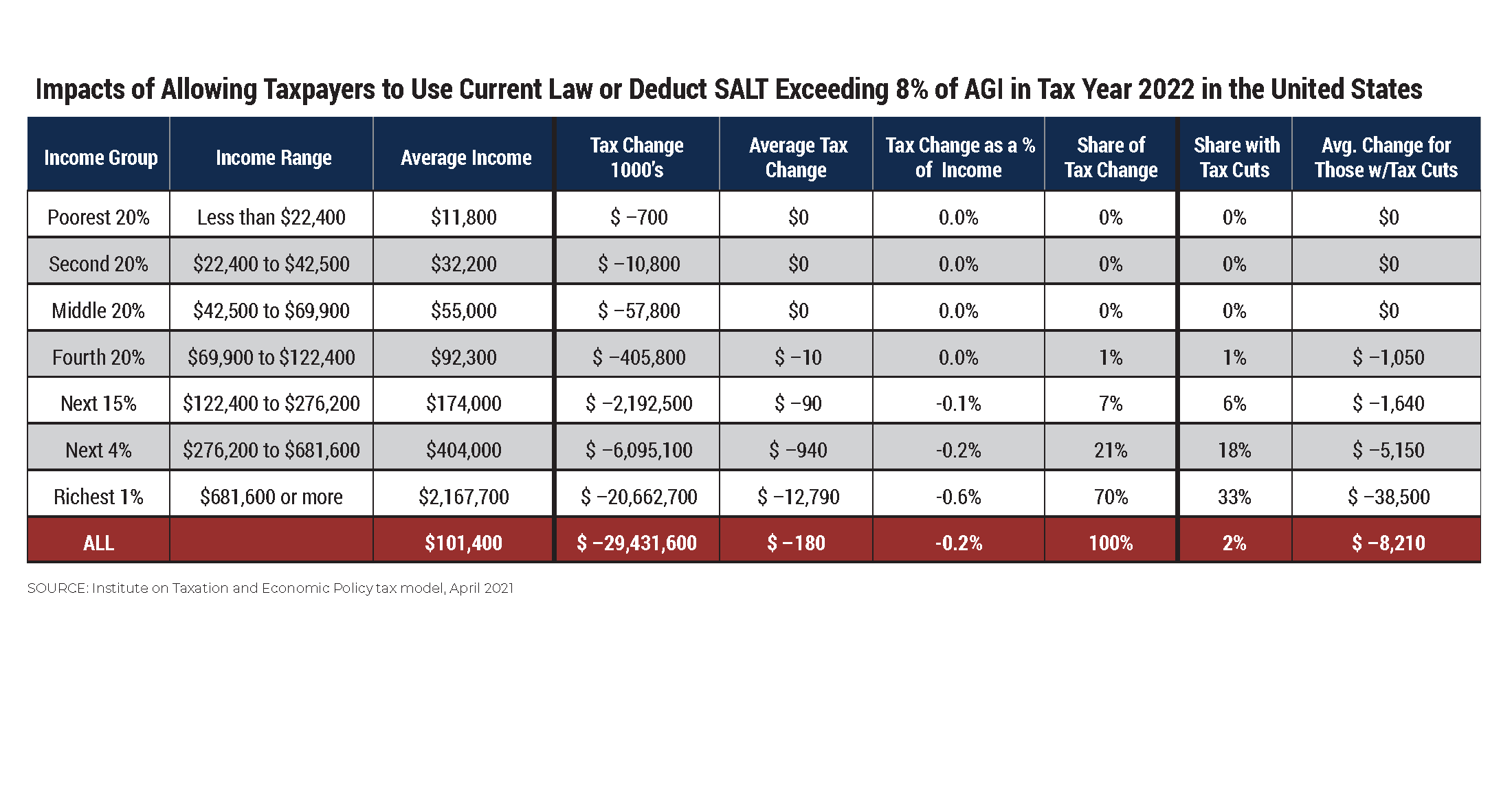

This limit applies to single filers joint filers and heads of household. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the Urban-Brookings Tax. Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on.

The SALT cap is the limit on a persons. No SALT no deal.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is Fat Fire The Best Early Retirement Lifestyle

State And Local Tax Salt Deduction Salt Deduction Taxedu

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Opinion The Debate Over A Tax Deduction The New York Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

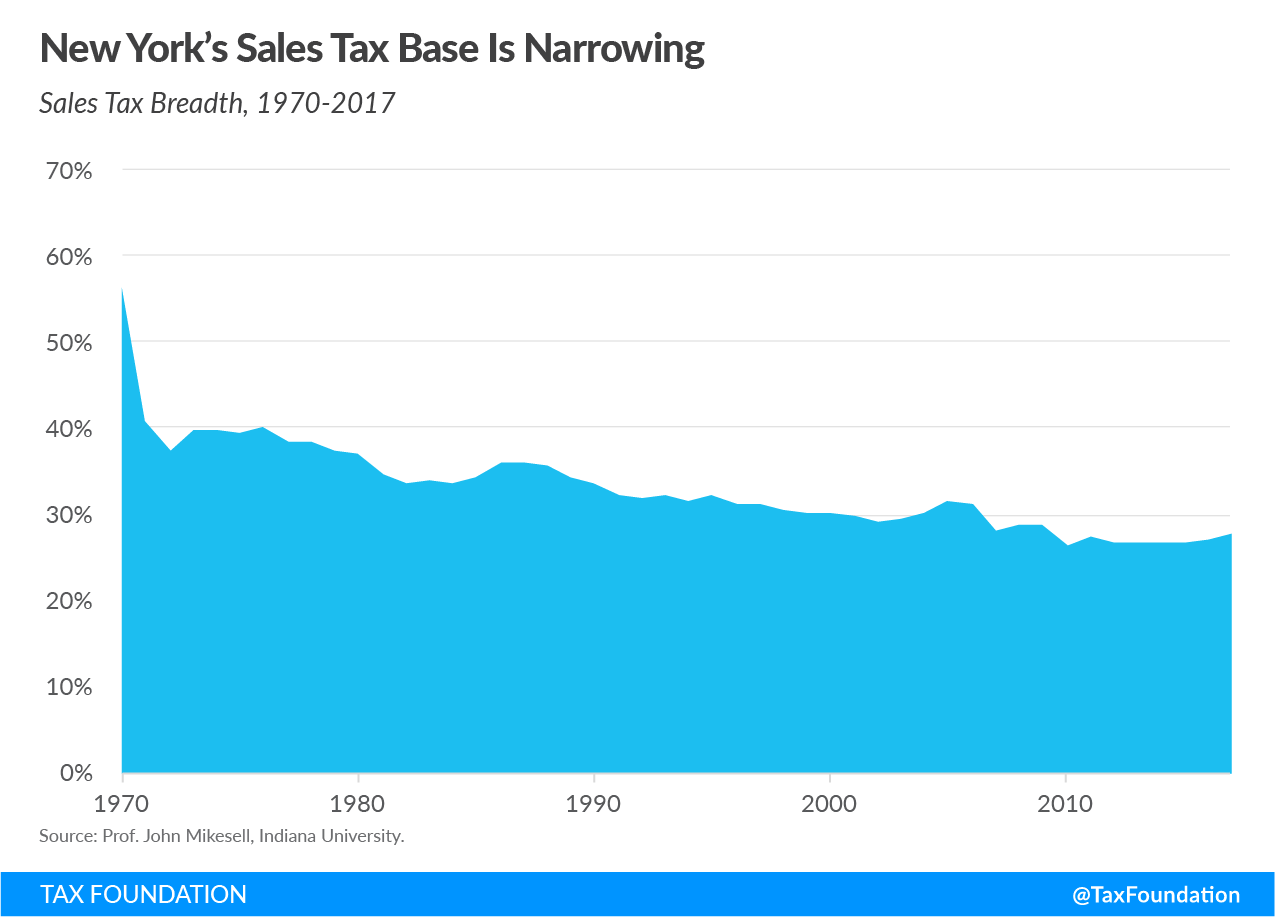

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

This Bill Could Give You A 60 000 Tax Deduction

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

What Is Fat Fire The Best Early Retirement Lifestyle

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Tax Bill S Long Term Harm Overshadows Salt Impact Nj Appleseed

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget